nd sales tax on vehicles

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. If the vehicle was purchased outside of the United States there is no tax reciprocity.

Sales Strategy Plan Template Inspirational Dws Associates Account Executive Sales Plan Template Proposal Templates Business Plan Template How To Plan

North Dakota imposes a sales tax on retail sales.

. These guidelines provide information to taxpayers about meeting their tax. Select the North Dakota city from the list of popular cities below to see its current sales tax rate. There are a total of 177 local tax jurisdictions across.

With local taxes the total sales tax rate is between 5000 and 8500. Tax Commissioner Ryan Rauschenberger reported today that North Dakotas taxable sales and purchases for the second quarter of 2021 are up 212 compared to the same timeframe in 2020. Any motor vehicle owned by or in possession of the federal or state government.

The North Dakota gas tax is included in the pump price at all gas stations in North Dakota. Average Sales Tax With Local. Qualifying vehicles entering North Dakota from another state under an optional lease period or open-end lease are subject to tax on the date the vehicle enters North Dakota for the remaining option period.

Name of Lessor Name of Lessee Year Make Model VIN. Local sales tax collections are administered under contract with the Office of North Dakota State Tax Commissioner who serves as a resource for local businesses on sales tax collection and reporting. Taxes would be due on the purchase price based on exchange at a rate of 5.

North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000. 39-05 are exempt from sales tax. North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3.

The rate of penalty applied to delinquent sales tax returns was changed to. Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. Sales tax was imposed on all vehicle rentals of less than 30 days at a rate of 5 and an additional 3 surcharge was imposed on vehicles weighing less than ten thousand pounds.

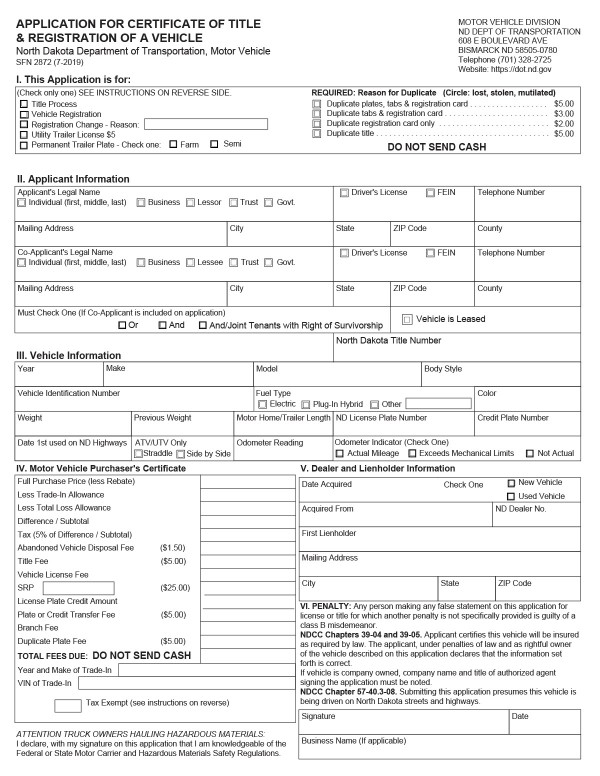

North Dakota Department of Transportation Motor Vehicle. This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax. In person services are provided by appointment only.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Include installation this is a retail sale of tangible personal property and Dealer A must itemize tax on the sales invoice and collect state sales tax of 2400 80000 X 3 and City Y tax of 3750 from Joe Buyer. Calculation of Motor Vehicle Excise Tax on Lease Consideration.

For vehicles that are being rented or leased see see taxation of leases and rentals. The North Dakota excise tax on gasoline is 2300 per gallon lower then 64 of the other 50 states. All fees will be recalculated by the Motor Vehicle Division and are subject to change.

Any two motor vehicles owned by or leased and in the possession of a disabled veteran pursuant to conditions set forth in North Dakota Century Code section 57-403-04. Learn more about different North Dakota tax types and their requirements under North Dakota law. North Dakotas excise tax on gasoline is ranked 32 out of the 50 states.

No walk-ins will be allowed. Nd sales tax on vehicles. North Dakota Sales Tax.

Schedule an appointment online or by calling toll free 1-855-633-6835. The sales tax is paid by the purchaser and collected by the seller. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on top of the state tax. North Dakota Gas Tax. Thursday September 9 2021 - 1000 am.

North Dakota sales tax is comprised of 2 parts. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. This system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax and other fees.

The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. Gross receipts tax is applied to sales of. Cass County citizens voted to Amend Article.

Will be provided for any sales tax use tax or motor vehicle excise tax paid to another state for the remaining lease period. NDDOT is following ND Smart Restart guidelines to ensure we are safely serving our customers. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

That state we would require proof of tax paid to exempt you from North Dakota excise tax. In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Instead motor vehicle excise tax is imposed on the purchase price of any motor vehicle purchased or acquired in or outside of the state of North Dakota for use on the highways and streets of this state and. Apportioned vehicles can not be calculated by this system. SFN 60399 1-2018 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E BOULEVARD AVE BISMARCK ND 58505-0780 Telephone 701 328-2725 Website.

ATTENTION DEALERS - If interested in Credit Only for ND. The gross receipts from sales of motor vehicles required to be titled under North Dakota Century Code ch. The following are exempt from payment of the North Dakota motor vehicle excise tax.

You can find these fees further down on the page. If you have any questions regarding the application of sales or use tax on sales of manufactured homes please contact the sales tax compliance section at 7013281246 or. North Dakota has recent rate changes Thu Jul 01 2021.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 35 across the state with an average local tax of 0764 for a total of 5764 when combined with the state sales tax. Cass County Government currently has a one-half percent local sales tax authorized by county voters for flood control measures. With respect to any lease for a term of one year or more of a motor vehicle with an North dakota nd sales tax rates by city.

Payment options vary by branch. 32nd highest gas tax. You can find these fees further down on the page.

Bid Today Auction Ends 3 22 19 Clock S Ticking This Fleet Inventory Reduction Auction In Lauderdale Mn Ends Automotive Repair Shop Fleet Automotive Repair

Brooklyn Toyota Plaza Toyota Driving Economy Cars Car Facts

Klassen Mercedes Sprinter Custom Auto

North Dakota Sales Tax Small Business Guide Truic

Pin By Rick Erickson On Austin Healey Sebring 5000 Bmw Bmw Car Sebring

Lew S Guy Stuff C Campers For Sale Fleetwood Campers Camper Parts

Ana S Birthday Gift Audi R8 Audi R8 White Audi Audi R8

The Dacia Jogger Looks Like This In The Basic Versions Dacia Joggers Volkswagen Multivan

About Bills Of Sale In North Dakota What You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

Nhl Toronto Maple Leafs 2 Pc Carpet Car Mat Set 17 X27 Nfl Car Car Mats Car Floor Mats

1994 Hummer H1 Presented As Lot S182 1 At Indianapolis In Hummer H1 Hummer Muscle Truck

What Your Nose Is Telling You Car Care Car Mechanic Car Facts

Classic Roadsters 1990 Sebring Healey 5000 Roadsters Classic Cars Mustang Ii