wayne county tax maps ohio

3 Metes Bounds Description. Ohio has 89 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Ohio being 65 and the highest Sales Tax rate in Ohio at 8.

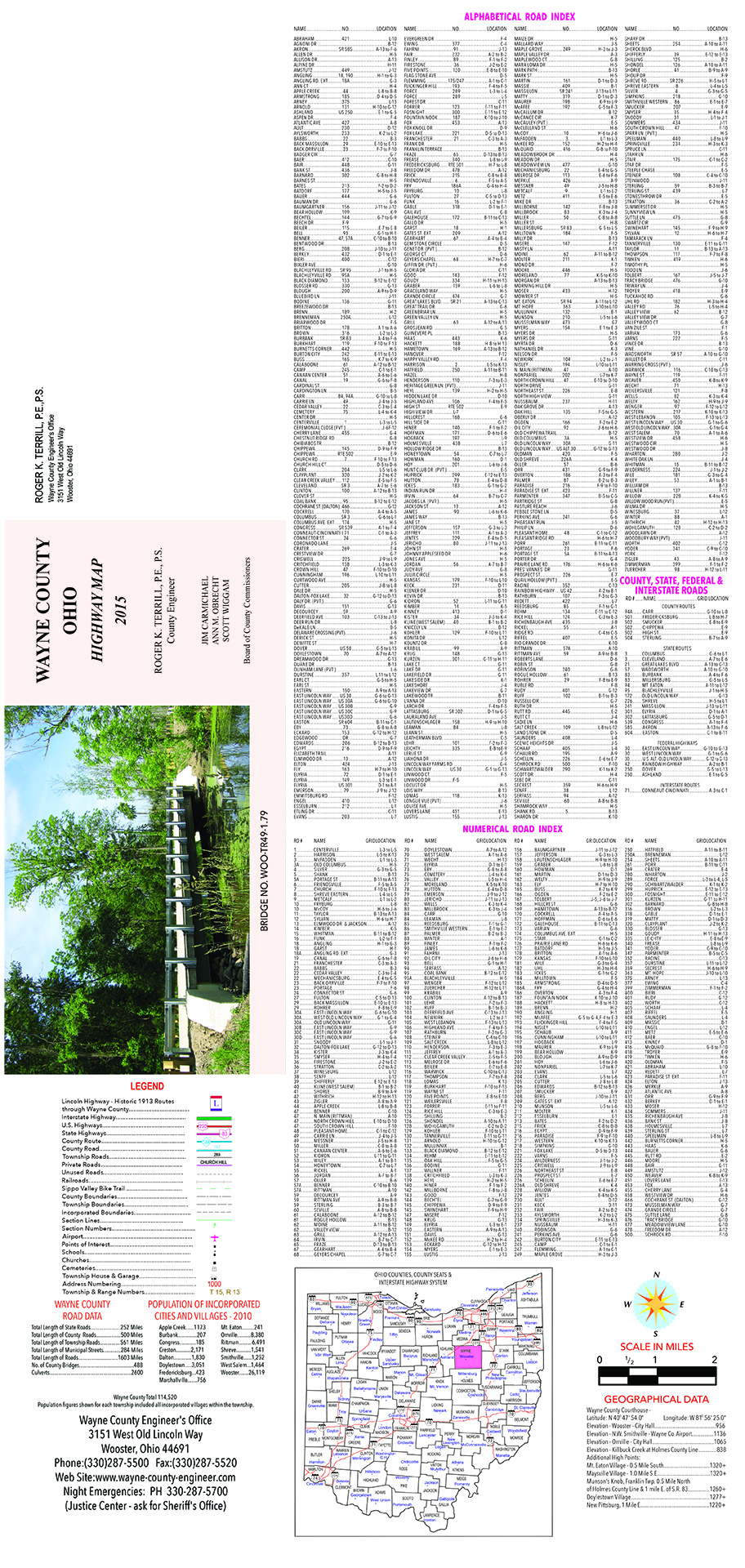

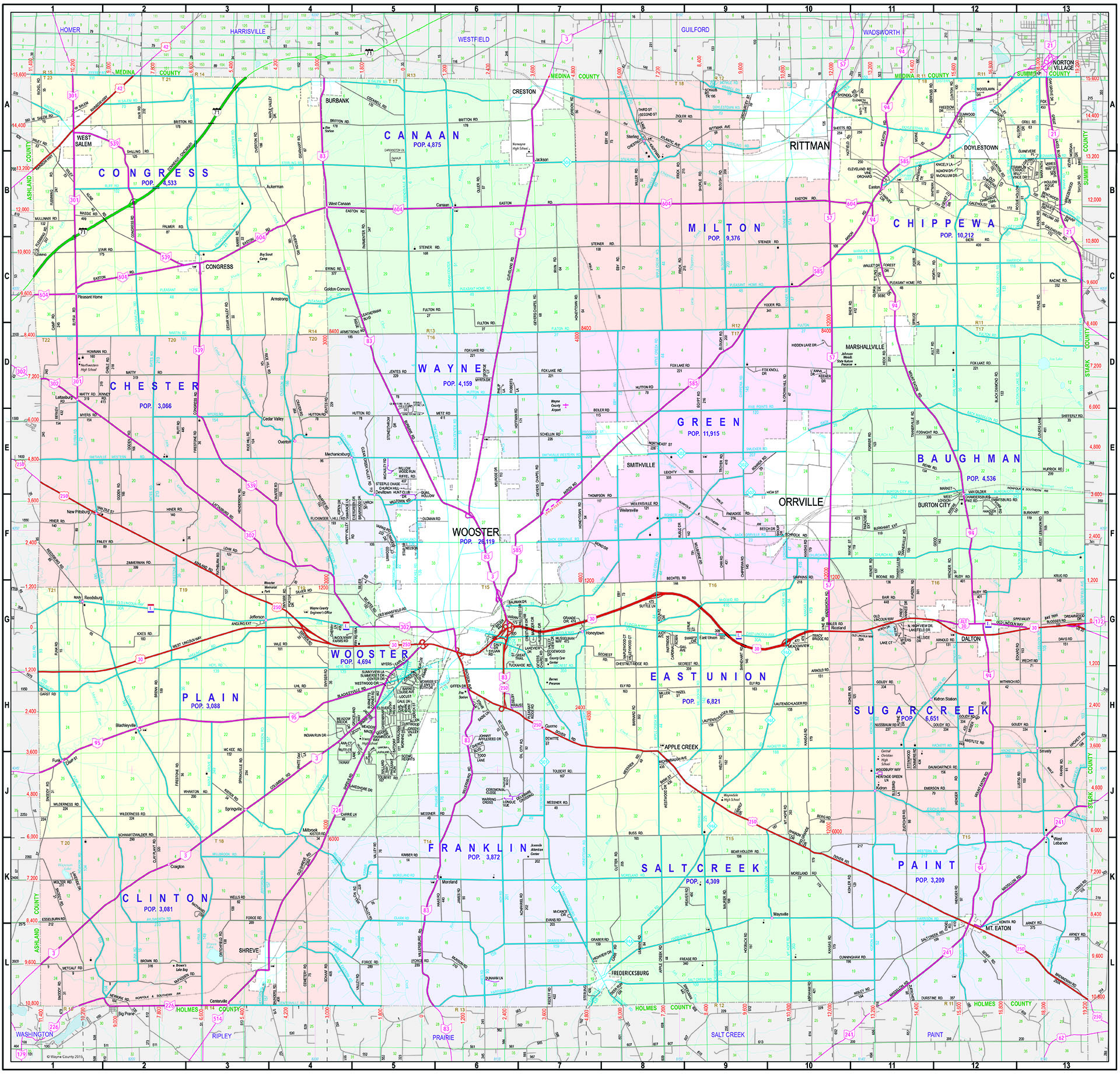

County Map Wayne County Engineer S Office

Authority responsible for maintaining county street addresses and tax survey maps used in reviewing deeds land transfers and lot splits.

. This table shows the total sales tax rates. Loading Do Not Show Again Close. The new updated system will have the ability to search for Transfer History by parcel in addition to cross-referencing such as parcel survey tax map Auditors Office data and aerial mapping making.

In the TOOLS section you will find Sales. The median property tax also known as real estate tax in Wayne County is 168600 per year based on a median home value of 13680000 and a median effective property tax rate of 123 of property value. Interactive Maps dynamically display GIS data and allow users to interact with the content in ways that are not possible with traditional printed maps.

Additional Geographic Information Systems GIS data and maps can be downloaded from the Wayne County website or purchased from the Wayne County Department of Technology. Of the eighty-eight counties in. The Wayne County Parcel Viewer provides public access to Wayne County Aerial Imagery collected in 2015 and parcel property information located within Wayne County boundaries.

Learn information about the Tax Department of Wayne County. Wayne county gis maps are cartographic tools to relay spatial and geographic information for land and property in wayne county ohio. County Auditor Wayne County Ohio HOME.

428 W Liberty Street. Wayne County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Wayne County Ohio. The acrevalue wayne county oh plat map sourced from the wayne county oh tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the.

Welcome to the Wayne County Auditor Websit e. These documents are reviewed and processed by mapping technicians who update property tax maps and property ownership. Box 227 Goldsboro NC 27530.

Wayne County in Ohio has a tax rate of 65 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Wayne County totaling 075. State and Permissive Sales Tax Rates by County April 2022. The Layer List on the right allows you to turn on and off a variety of GIS layers.

Government and private companies. You can also download surveys or tax maps measure length or area annotate the map print maps and view recent sales. Find API links for GeoServices WMS and WFS.

Tax Map Wayne County Engineers Office. The AcreValue Wayne County OH plat map sourced from the Wayne County OH tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Wayne County Ohio Government Web Site Maps Office.

They are maintained by various government offices in. Ohio has a 575 sales tax and Wayne County collects an additional 075 so the minimum sales tax rate in Wayne County is 65 not including any city or special district taxes. This includes zooming and panning the map selecting features to gain additional information and in some cases conducting analysis on geospatial information.

How Does Sales Tax in Wayne County compare to the rest of Ohio. Pay Tax Bills Online Through Point and Pay. The Wayne County Parcel Viewer provides public access to Wayne County Aerial Imagery collected in 2015 and parcel property information located within Wayne County boundaries.

Pay Real Estate or Manufactured Home Tax Bills online through Point and Pay. 2 P a g e. The median property tax in Wayne County Ohio is 1686 per year for a home worth the median value of 136800.

428 W Liberty St Wooster OH 44691 P. The Assessment Office is administered under Title 53 Chapter 28 of the Consolidated Assessment Law. 1 P a g e.

You can find more tax rates and allowances for Wayne County and Ohio in the 2022 Ohio Tax Tables. City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Wayne County Auditors Geographic Information System website allows you to search properties by Owner Address or Parcel Number. Wayne County Property Records are real estate documents that contain information related to real property in Wayne County Ohio. Wayne county board of commissioners sue smail becky foster ron amstutz county administration building 428 west liberty street wooster oh 44691.

How is Sales Tax. Taxohiogov County County Tax. Wayne County Tax Map Office.

Wayne County is a Sixth Class County. Wayne County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Wayne County Ohio. Property information may be accessed by using the search bar or SEARCH link on the upper right of the page.

GIS Maps are produced by the US. Wayne County Tax Map Office. Tax Rates By City in Wayne County Ohio.

Find API links for GeoServices WMS. This site is best viewed in resolutions of 1024x768 or greater using Firefox Chrome Safari or IE9 or greater. Welcome to Wayne County Parcel Viewer.

GIS stands for Geographic Information System the field of data management that charts spatial locations. You can utilize the INFO section on the upper right to view information on the various services offered by this office and access the numerous forms required. Skip to Main Content.

Wayne County Tax Map Office. Effective May 3 2021 parcel data can be found here. Ad Find Out the Market Value of Any Property and Past Sale Prices.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The Mapping Department receives documents recorded in the Recorder of Deeds Office. Physical Address View Map 224 E Walnut Street Goldsboro NC 27530.

Wayne County is a Sixth Class County. Wayne County Ohio Government Web Site Maps Office. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Jefferson 150 725 Wayne 075 650 Knox 150 725 Williams 150 725. M-F 800am - 430pm. Wayne County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Cities Villages Wayne County Ohio

Barberton Barberton Ohio Ohio Travel Ohio History

Ohio County Map Ohio History Ohio Map Huron County

Ohio County Map Ohio History Ohio Map Huron County

Ohio County Map Shown On Google Maps

Historic Map Lima Oh 1892 Lima Ohio Ohio Birds Eye View Map

County Map Wayne County Engineer S Office

Here S The 3 Ways Ohio Districts Plan To Return To School

Map Available Online Ohio Cadastral Maps Library Of Congress

Map County Auditor Website Wayne County Ohio

Indiana County Map County Map Indiana Michigan City

Deja Vu Republicans Use Simple Majority To Pass 4 Year Maps Ohio Capital Journal

Wayne County Auditor Gis Open Data

Recommended Locations Ohio Http Travelsfinders Com Recommended Locations Ohio Html Ohio Map Ohio Map

Gop Says Attempts On Partisanship Make Ohio Statehouse Maps Constitutional Ohio Capital Journal

Ohio Townships Map Ohio Township Association

Ohio Vector Map Regions Isolated Stock Illustration Download Image Now Istock

Map County Auditor Website Wayne County Ohio

Map Of Washington County Ohio From Actual Survey Records By Wm Lorey Library Of Congress